More from News 12

State police: Victim of I-684 car crash identified as convicted murderer in country illegally

1:37

Sunny in the 60s today, light showers expected tomorrow morning

Source: 16-year-old arrested in Newburgh stabbing near high school

Montgomery man charged, officer’s conduct under review following Walmart larceny

Police: Goshen home vandalized in hate crime

0:56

Brooklyn man charged with scamming Westchester resident out of $28K

0:18

Fire outside L.L. Bean Store in Town of Ulster quickly extinguished

0:27

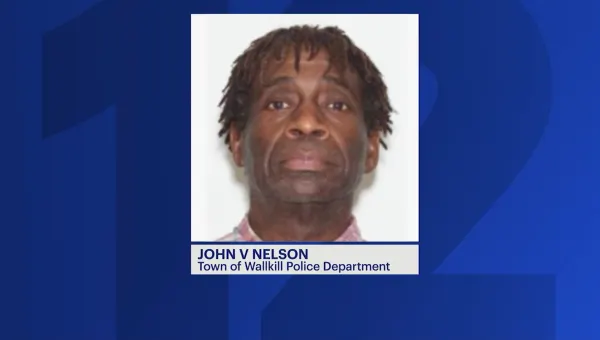

Police: Wallkill man reported missing found dead in home

2:09

Unconscious woman rescued from Spring Valley apartment complex fire; firefighter injured

Vote 2024: Ask your questions for Congressional District 16 Democratic candidates

0:20

3 Hudson Valley small towns ranked among best places for retirement

0:36

Wake and funeral announced for Westchester correction officer killed in crash

0:36

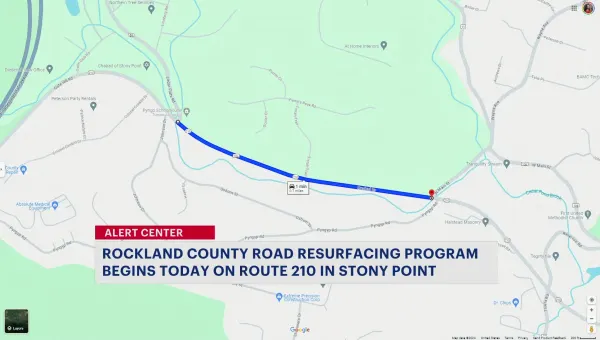

Rockland County road resurfacing program begins

0:32

Naming contest announced for baby falcons on Mario M. Cuomo Bridge

0:42

State DEC introduces new shark handling regulations for marine anglers

0:24

New gastropub The Governess set to open on Poughkeepsie's waterfront

0:56

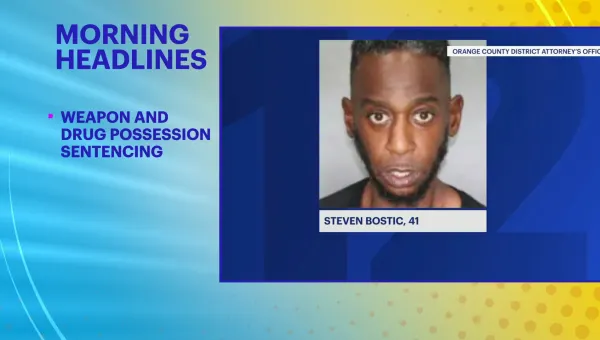

Headlines: 2 men from Orange County sentenced for drug dealing, Ulster County drug and weapon bust

0:40